In an increasingly complex world of investments and financial schemes, promises of swift profits frequently enough blur the line between chance and risk. A recent incident has captured attention: a seemingly straightforward transaction involving a 10-yuan lock on 1 gram of gold unexpectedly spiraled into a perplexing ordeal. What was meant to be a simple financial gain turned into a stalled process—one guarded by an unyielding lock and elusive signatures. behind this puzzling situation lies a web of miscommunications,unfulfilled promises,and questions about trust and transparency in today’s commercial landscape. This article delves into the details of this case, exploring how a seemingly innocent transaction can reveal deeper issues within business operations and investor confidence.

Understanding the Pitfalls of Quick-Investment Schemes and Their Risks

Many quick-investment schemes lure individuals with promises of high returns for minimal effort, often using compelling narratives to attract unwary participants. They tend to capitalize on the excitement of quick gains, leading investors to overlook the inherent risks involved. Accordingly, such schemes frequently operate with minimal transparency, making it arduous for investors to fully understand where their money is going or how the promised returns are generated.In many cases,once the funds are transferred,the promised rewards disappear,leaving investors shocked and financially strained.

Recognizing the warning signs can help prevent falling into these traps:

- Unclear or overly aggressive promises – “Double yoru money overnight” is often too good to be true.

- Lack of verifiable documentation – Absence of official agreements or obvious audit reports.

- Pressure to act quickly – Calls to make swift decisions without sufficient due diligence.

- Suspicious payment processes – Such as locking up funds without formal authorization or official sign-off.

| Red Flag | Sign of a Risky Scheme |

|---|---|

| Promises of guaranteed high returns | Lack of risk disclosures and overly optimistic outcomes |

| Opaque payment procedures | Unclear processes locking funds without proper documentation |

| High-pressure sales tactics | Rushed decisions without room for questions or review |

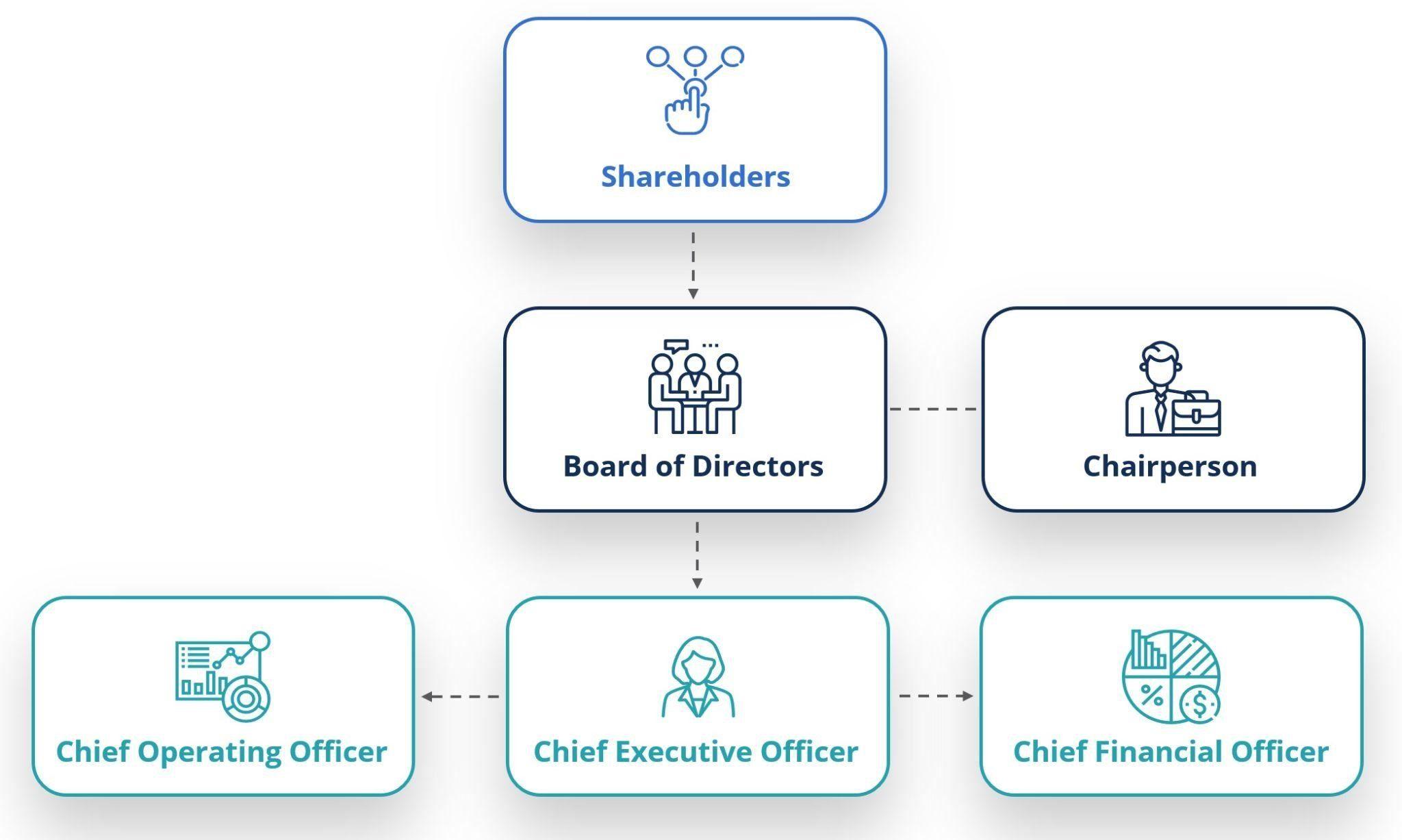

Analyzing the Role of Company Governance and Internal Controls in Financial Transactions

Effective company governance and robust internal controls are the backbone of secure financial transactions. When oversight mechanisms are weak or inconsistently applied,opportunities for misappropriation,errors,or fraud multiply. In scenarios where decision-making authority is centralized without clear checks and balances—such as the inability of employees to secure a signatory—risks escalate. Without transparent procedures, funds can be prematurely locked or diverted, undermining trust and jeopardizing long-term sustainability.

To mitigate these risks, organizations should prioritize establishing thorough internal controls, including approval hierarchies, audit trails, and periodic oversight. Key elements might include:

- Mandatory approval workflows for large transactions

- Regular internal audits to detect irregularities

- Clear delegation of authority with documented sign-off procedures

- Automated transaction monitoring systems

| Control Measure | Purpose |

|---|---|

| Approval Hierarchies | Ensures only authorized personnel approve transactions |

| Audit Trails | Provides a record for accountability and review |

| Delegated Authority | Prevents unauthorized or rushed payments without proper sign-off |

Identifying Red Flags and Warning Signs in Unverified Investment Promises

One of the most common red flags in suspicious investment schemes is the promise of quick, guaranteed profits with minimal effort. Be wary of offers that sound too good to be true,especially when they involve locking in funds before any transparent verification process. Authentic investments typically require clear documentation and regulatory approval; if these are missing or if the vendor avoids providing verifiable details, it’s a significant warning sign. Scammers frequently leverage appealing narratives—like turning a small amount into a larger sum overnight—to lure unsuspecting individuals into transferring their money.

Sometimes, dishonest operators create obfuscation by delaying or refusing to sign bank transfers, citing vague reasons such as “老板没法签字打款” (“the boss cannot sign the payment”). Observable warning signs include:

- Pressure to invest quickly without proper due diligence

- Lack of transparency or credible contact data

- suspicious payment channels or upfront fees

- inconsistent or incomplete company details

| Red Flag | Typical Warning |

|---|---|

| Unverified Promises | “Guaranteed profits” without proof or legal backing |

| Vague Payment Processes | Unexplained delays or refusal to sign official contracts |

| Unclear Company Info | Absence of verifiable licenses or registration details |

Strategic Recommendations for Safeguarding Your Investments and Avoiding Similar traps

To protect your investments from falling into similar traps, it’s crucial to exercise rigorous due diligence before engaging in any financial schemes. Always verify the legitimacy of the platform, scrutinize the credibility of project claims, and avoid offers that sound too good to be true. Furthermore, establish transparent dialog channels with the company or project team, ensuring there is clear documentation and verification of all transactions. Remember, legitimate investments typically require formal approvals, signatures, and consistent updates—red flags often arise when processes are opaque or rushed.

Implementing preventive measures can substantially reduce your exposure to financial risks. Consider the following strategies:

- Demand written contracts with clear terms and conditions.

- Use secure, traceable payment methods such as bank transfers or escrow services.

- Maintain a detailed record of all communication and transaction history.

- Consult independent financial advisors before proceeding with significant investments.

| Key Safeguards | Practical Actions |

|---|---|

| Legitimacy Checks | Verify licenses and background of the firm thoroughly |

| Contract Transparency | Insist on written agreements and official signatures |

| Payment Security | Utilize escrow services or verified banking channels |

the Conclusion

In the whirlwind world of investment promises and tempting offers, it’s essential to approach with careful scrutiny. What seemed like a simple opportunity to lock in gold at a bargain unexpectedly turned into a lesson on due diligence. As stories like this unfold, they serve as a reminder to stay vigilant, verify details thoroughly, and avoid rushing into schemes that promise quick gains. safeguarding your hard-earned money remains the most valuable investment of all.