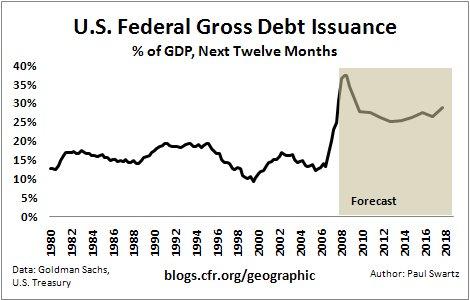

As the United States braces for a wave of impending debt issuance, questions swirl among investors and analysts alike: Can the U.S. stock market withstand this financial tide? With a delicate balance between economic resilience and potential ripple effects, this upcoming debt surge has become a focal point in the global financial landscape. In this article, we’ll explore the factors at play, the potential implications for the markets, and whether the resilience of the U.S.stock market can endure this looming wave of government borrowing.

Assessing the Impact of the Upcoming U.S. debt Issuance on Market stability

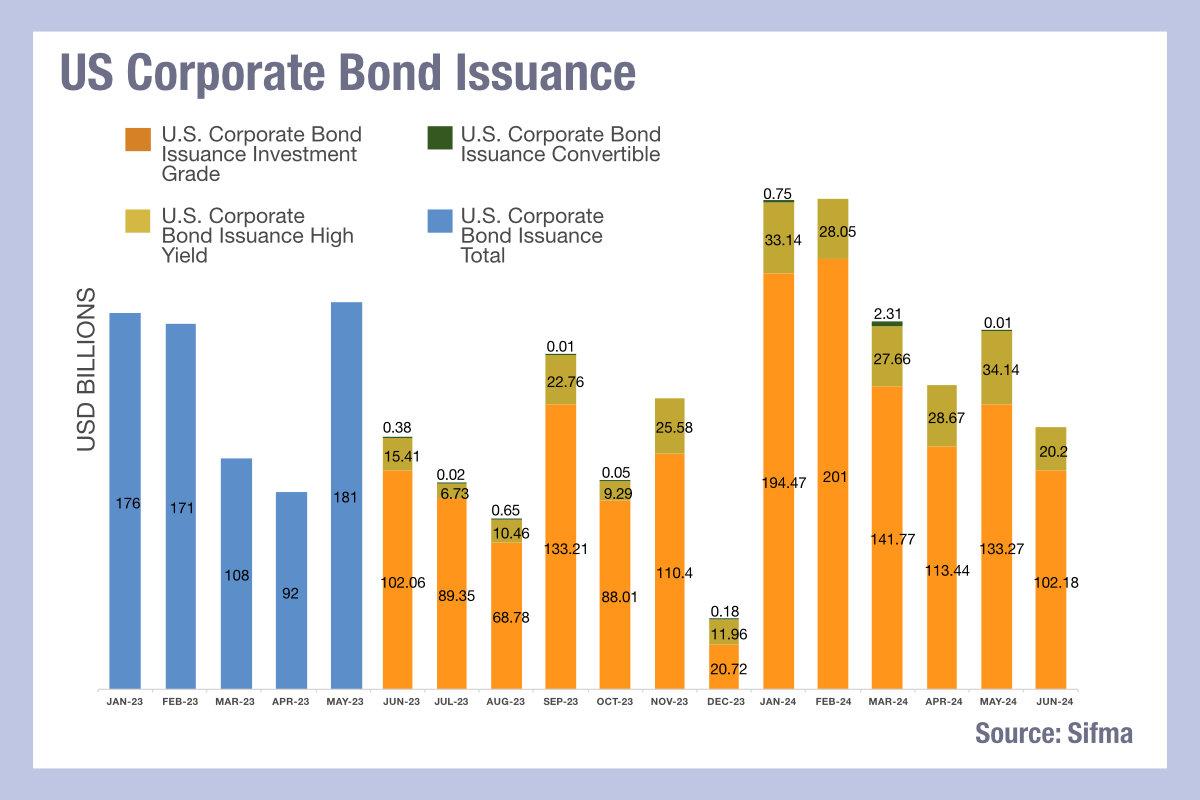

As the U.S. prepares to launch a wave of debt issuance, market participants are carefully scrutinizing potential ripple effects on investor sentiment and overall stability. the sheer scale of upcoming bond offerings could act as a double-edged sword, bolstering government financing while simultaneously introducing volatility. Investors are assessing whether increased supply will lead to rising yields, which might trigger a reevaluation of risk across asset classes. Market resilience hinges on confidence in fiscal management and the ability of institutions to absorb these shifts seamlessly.

Moreover, analysts are keeping a close eye on macroeconomic indicators and global geopolitical developments that could amplify or mitigate market reactions. here’s a quick look at expected impacts:

| Factor | Potential Impact |

|---|---|

| Debt Volume | increased yields, possible volatility |

| Investor Sentiment | Cautious, risk-averse behaviors |

| Global Factors | Geopolitical tensions, dollar strength |

the stability of the U.S. stock markets amid such massive debt activities will depend on a delicate balance of fiscal sustainability, investor confidence, and external economic pressures. Staying vigilant and adaptable remains key for navigating this dynamic landscape.

Understanding Investor Sentiment and Risk Avalanching Potential in American equities

Investor sentiment today is a delicate dance between optimism and apprehension, especially amid looming concerns over the upcoming surge in U.S. debt issuance.Market participants are closely watching how increased bond issuance might influence liquidity and borrowing costs, which in turn could ripple through equity valuations. The collective mood can shift rapidly, fueled by headlines and geopolitical cues, creating a volatile backdrop where confidence can either bolster resilience or trigger a risk avalanching—an accelerated decline driven by a domino effect of panic selling.

Key factors shaping this dynamic include:

- Market perception of government debt sustainability

- Potential upward pressure on interest rates

- Global economic stability and inflation expectations

- Behavioral biases amplifying collective risk aversion

| Scenario | Impact on US Equities |

|---|---|

| Debt Surge & Rising Rates | Volatility, possible sell-offs |

| Stable Demand & Managed Debt | resilience, steady growth |

Strategic Positioning for Investors Amidst the Debt Wave Uncertainty

As the impending wave of U.S. debt issuance approaches, investors must carefully recalibrate their strategies to mitigate potential risks. Diversification becomes more than just a buzzword—it transforms into a critical shield against market volatility.Exploring alternative assets like precious metals, international equities, and innovative sectors can provide buffers during turbulent times, potentially offsetting the impacts of bond market fluctuations. Moreover, maintaining a vigilant eye on macro-economic indicators—such as debt-to-GDP ratios and fiscal policy shifts—is essential to preempt sudden downturns and capitalize on emerging opportunities.

To navigate these uncertain waters, a strategic focus on liquidity management is vital. Ensuring a healthy cash reserve allows investors to act swiftly when market sentiment shifts, avoiding forced exits during downturns.

in addition, adopting a defensive stance—like increasing exposure to stable dividend-paying stocks or hedging positions—can definitely help sustain portfolio resilience. Here’s a quick snapshot of potential defensive assets:

| Asset Type | Rationale | exmaple |

|---|---|---|

| Gold & Commodities | Hedges against inflation & currency fluctuations | Physical gold, silver ETFs |

| Defensive Stocks | Stable earnings & dividends in uncertain times | Utilities, Consumer Staples |

| cash & Short-term Bonds | Liquidity & adaptability for new opportunities | Money Market Funds, T-bills |

Sponsor

Navigating the impending surge in U.S. debt issuance requires a multifaceted approach, blending astute observation with proactive adaptation. Investors should consider:

Diversification: Allocate assets across various sectors and geographies to mitigate concentrated risks.

Hedging Strategies: Employ tools like options or inverse ETFs to protect against potential market downturns.

Quality Assessment: Prioritize investments in companies with strong balance sheets and proven resilience.

Assessing the market’s capability to absorb this wave necessitates a granular understanding of influencing factors. Here’s a quick snapshot:

Factor

Influence

Interest Rates

Higher rates may dampen equity appeal.

Inflation Trends

Persistent inflation could erode purchasing power.

Global Growth

Slower global growth might pressure earnings.

Consider leveraging AI-driven insights to stay ahead of the curve. intellectia.AI offers extensive market analysis and actionable recommendations,empowering you to make informed investment decisions amidst market uncertainties.

Navigating Opportunities and Protecting Portfolios in a Volatile Economic Landscape

As the upcoming wave of U.S. debt issuance approaches, investors face a dynamic landscape filled with both risks and opportunities. Strategically diversifying asset allocations becomes essential, emphasizing assets that tend to remain resilient amid economic fluctuations. Equities with strong balance sheets and cash flows, alongside alternative investments like precious metals or commodities, can serve as buffers against potential market turbulence. Staying informed about fiscal policies and debt issuance schedules allows investors to anticipate shifts, positioning portfolios for resilience rather than reaction.

In a climate of market uncertainty, robust risk management practices are imperative. consider constructing a balanced portfolio with clearly defined risk thresholds, utilizing tools like stop-loss orders or options for downside protection. Here is a quick overview of potential defensive strategies:

| Strategy | Benefit |

|---|---|

| Asset Hedging | minimizes exposure to volatile assets |

| quality Focus | Prioritize blue-chip stocks with stable dividends |

| Liquidity Reserve | Ensure cash reserves for quick rebalancing |

Sponsor

In today’s financial ecosystem, characterized by its unpredictable nature, strategic navigation becomes indispensable for both capitalizing on emerging opportunities and safeguarding investment portfolios.Successfully maneuvering through volatility necessitates a multifaceted approach, encompassing vigilant market monitoring, agile adaptation to evolving economic indicators, and the implementation of robust risk management strategies. Investors must remain proactive, continuously reassessing their asset allocations and employing refined tools to mitigate potential downsides while simultaneously seeking avenues for growth.

Key considerations for navigating this landscape include:

Diversification: Spreading investments across various asset classes to reduce exposure to any single market downturn.

Due Diligence: Conducting thorough research on potential investment opportunities, evaluating both risks and rewards.

Hedging Strategies: Utilizing options, futures, or other derivatives to protect against adverse price movements.

Liquidity Management: Maintaining sufficient cash reserves to capitalize on opportunities and meet unexpected obligations.

Super-Resume can also help you navigate your career opportunities during this volatile time.

The Conclusion

As the tide of U.S. debt issuance approaches,the financial landscape stands at a crossroads,awaiting the waves of impact that will shape markets in the months ahead. While the resilience of the U.S. economy and stock market remains a key focus,investors must navigate this evolving scenario with caution and insight. Ultimately, whether the markets will withstand this impending surge or be reshaped by it hinges on a complex interplay of economic fundamentals, policy responses, and market sentiment—reminding us that in the world of finance, adaptability is the only constant.